‘Paytm Karo’ is the sound that reminds India of its kind of fintech innovation. The journey of Paytm and its founder Mr. Vijay Shekhar Sharma is the journey of the new aspirations of India. Paytm has changed the experience of financial transactions through its unique mechanism and the exceptional innovation of UPI has subsequently made it a giant fintech company. Since its launch in 2009, Paytm has evolved into a familiar household name for digital payments and related services. It is one of the largest digital payment outlets in the country and the most valuable startup.

Interestingly, very few people know that Paytm is owned by One97 Communications Limited. Its investors include Softbank, Ant Financial, AGH Holdings, SAIF Partners, Berkshire Hathaway, T Rowe Price, and Discovery Capital. One97 has many subsidiaries among which Paytm is one. Its biggest success story is Paytm Payments Bank. It is the country’s largest digital bank with over 58 million account holders.According to the stats released by the Paytm in last financial year, the company has a 333 million+ customer base and 21 million+ registered vendors to whom, the firm, offers payment services, financial services, and e-commerce and cloud services. The strong point of Paytm is that it has something for everyone, whether you are a consumer or a vendor.

The Fall of Paytm IPO

While discussing the fall of Paytm, one point must be clear in the mind that the valuation of Paytm has been down not the business, which makes it more interesting. On the 8th of November 2021, Paytm India has unwrapped the biggest ever IPO of the Indian stock market to generate an amount of ₹18,300 crores, which comprised of a fresh issue of ₹8,300 crores and ₹10,000 crores under offer for sale, with a price band of 2,080-2,150. As the valuations were not in line with its past financial statements, it received a halfhearted response with a 1.9 times subscription. The issue price of its shares was fixed at Rs 2150.

On the day of its listing on the stock exchange, Paytm witnessed a fall of 26% in its share value. It came down to ₹1586. Due to gradual price correction in the secondary market, the current price range of each share is ₹550- 580 which is one-third compared to the listing price. On the first day of listing the Paytm valuation was Rs 1.49 trillion. But as it was listed on the stock exchange, on the same day its valuation falls to ₹70,418 crores. The steep fall in Paytm’s worth is a lesson for new edge companies that overvalued companies are more likely to fall during uncertainties/corrections in the market.

The RBI stick on Paytm

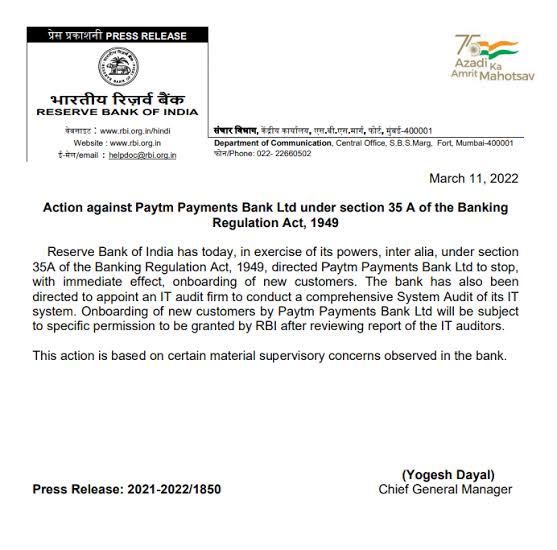

The bad news for Paytm is not looking to end for now. On one hand, its market valuation and share prices are underperforming and on the other hand, RBI has again put its stick on it. On March 11, 2022, RBI has issued a circular and stopped the Paytm Payment Bank from adding new customers. Moreover, RBI has ordered a transparent IT Audit of it. This news has made Paytm more anxious and damaged the Brand. The RBI believes that Paytm is not following the required guidelines for KYC.

But the anxiety of RBI has more concern from the point of view of India expanding digital financial market. Paytm is the largest service provider which has a piece of huge financial information and any data leak may cause huge damage to the financial system. So it’s necessary to have proper control over the digital financial market. The transparency of Paytm is necessary for the Indian fintech future.

(Writer is the Founder and President of Finance and Economics Think Council and daily contributor in India leading news houses)